Security

Mortgage Backed Investments opportunities offer a unique level of security compared to other asset classes.

-

1

Asset Backed Security

Every opportunity is backed by a first mortgage over real Australian property. In the event of an unremedied default, the Investment Manager can seize and sell the property asset.

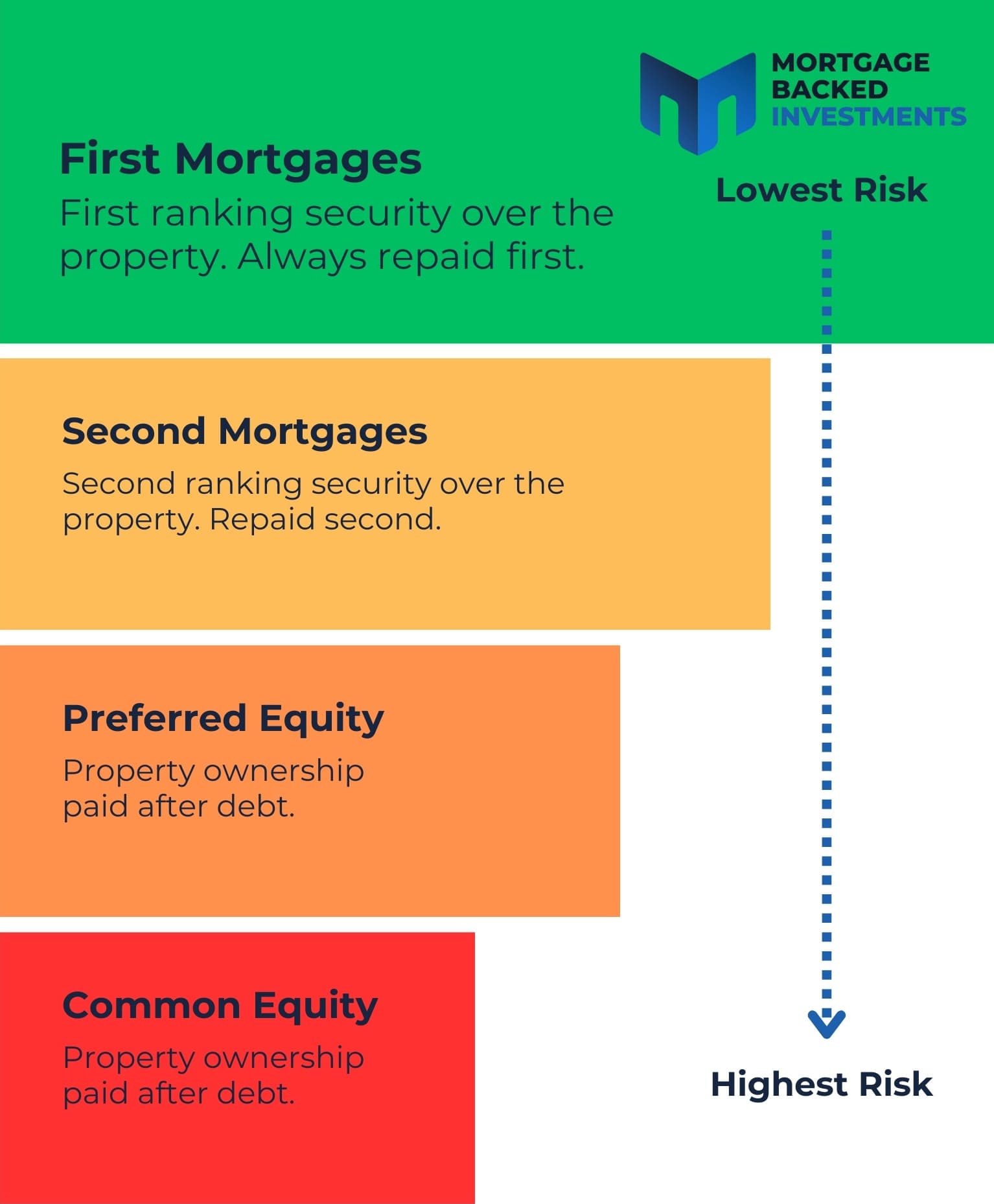

Mortgage Backed Investments opportunities are all backed by mortgages, with first-ranking security over real property assets. In the event of a sale of the property, the first mortgage holder’s funds are returned first.

Moreover, funds are exclusively allocated to dynamic projects that aim to increase the value of the secured property, ensuring no stagnant investments.

First Mortgage Security Payment Priority

Conservative Loan to Value Ratio (LVR)

-

2

Conservative Loan-to-Value Ratio

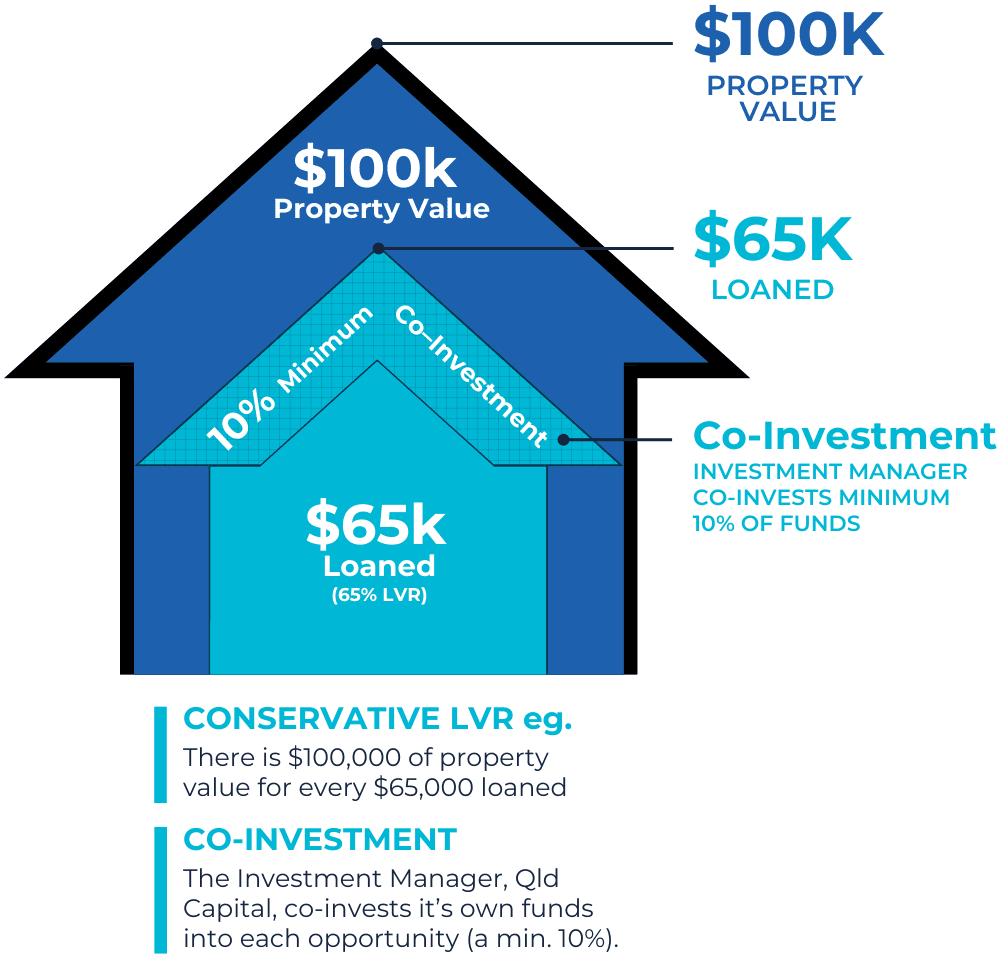

The Loan-to-Value-Ratio (LVR) refers to the loan value relative to the total property value. It is an important risk mitigation tool that ensures sufficient headroom to recoup investment and interest in the event of a loan problem.

Low LVR provides a strong buffer, ensuring enhanced security for your investments. MBI opportunities prioritise capital preservation and protection of your investment.

Independent valuations must validate property values for each opportunity before any advance.

Mortgage-backed Investment opportunities’ loan-to-value ratios are usually a conservative 65% or lower (e.g., there is at least $100,000 of property value for every $65,000 lent).

-

3

Not a Pooled Fund

Investments are project-specific and offered within special-purpose lending entities. Mortgages are not grouped or pooled, so there is no contagion risk from the conduct of other loans or other investors. Investment funds are held in trust until all security (including mortgages) are in place.

Investors have a direct relationship with the special-purpose lending entity that holds the specific mortgage security. They may further diversify their investment with Mortgage Backed Investments by investing across several opportunities.

-

4

Co-Investment Confidence

Qld Capital, the investment manager, invests its own funds into each opportunity on a first-loss basis, meaning its capital is at risk before all other investors.

-

5

Strong Market Segment

MBI strategically focuses on small to medium-scale commercial debt opportunities, offering a range of benefits.

With shorter project timelines and reduced complexity, these opportunities provide a better chance to address any issues that may arise.

Additionally, the market segment’s wider participation creates a stronger environment, reducing overall risk and increasing the potential for successful outcomes.

-

6

Highly Experienced Investment Manager

The investment manager, Qld Capital, has been providing mortgages using its own funding since 2016. They use this extensive knowledge and expertise to identify viable projects.

They possess a deep understanding of market dynamics, risk management strategies, and financial analysis, leveraging their experience, we evaluate and select mortgage backed investments that align with rigorous criteria for risk reduction, strong return and capital preservation.